Goldman Sachs’ recent report presents long-term macroeconomic projections until 2075, envisioning India’s ascent as the second-largest economy by that horizon. The study emphasises the pivotal role of emerging markets, remarkably dynamic Asian powerhouses, exhibiting higher growth rates vis-à-vis developed economies. Projections indicate that China is poised to overtake the United States in economic size around 2035. Despite an anticipated deceleration in global growth due to demographic constraints in trend, emerging markets are foreseen to sustain their upward trajectory. However, it is imperative to acknowledge the inherent uncertainties and risks intrinsic in long-term forecasting while comprehending prevailing macroeconomic dynamics shaping the global economy. These projections offer invaluable insights into the evolving economic landscape, yet prudence must be exercised given the lingering uncertainties ... A special report by Dr Maheep

Goldman Sachs, the world’s second-largest investment banking corporation, published a report in early July with a conjecture that India may become the second-largest economy in the world by 2075. Goldman Sachs Research launched its first long-term projections for the economies of Brazil, Russia, India, and China (BRIC) almost 20 years ago. They have since expanded those estimates in 2011 to include more countries. Their latest report published an updated version of those projections to cover 104 countries out to 2075.

Global population control is a necessary condition for long-term environmental sustainability. But an ageing population which is growing more slowly will have to cope with rising healthcare and retirement costs. The number of countries that face a serious economic challenge from a greying population is likely to consistently increase in the coming decades.

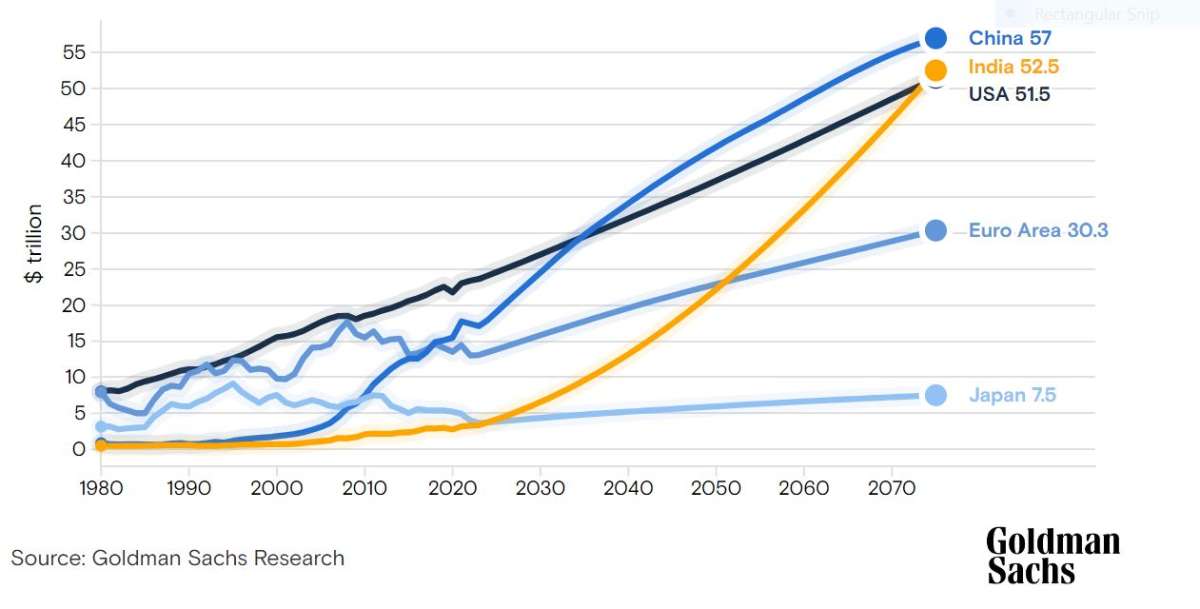

Emerging economies, led by powerhouses in Asia, are growing faster than developed ones, while expansion in real (inflation-adjusted) global GDP slows. Their share of the world economy is likely to rise, and their incomes are expected to slowly accumulate toward those of richer countries. China may overtake the U.S. as the world’s largest economy by around 2035 while India is expected to be the world’s second-largest economy by 2075.

The report makes four significant predictions for the global economy. First, it forecasts a slowdown in global growth, partly due to weaker population growth. However, emerging markets, especially Asian powerhouses, will continue to experience growth. Third, the report suggests that the US economy may also slow down in the long run. Finally, it anticipates a decline in global wealth inequality between countries, but a rise in inequality within countries. These predictions shed light on the changing dynamics of the global economic landscape, urging us to carefully consider the challenges and opportunities that lie ahead.

During the period spanning the early 2000s to the 2007-08 Global Financial Crisis (GFC), global growth exhibited exceptional robustness, particularly evident in emerging markets (EM). This surge in economic activity was significantly fuelled by the rapid process of globalization. Interestingly, while the GFC inflicted recessions upon developed economies, the majority of emerging markets displayed remarkable resilience in weathering the crisis. In fact, the initial set of Goldman Sachs’ BRIC projections, comprising Brazil, Russia, India, and China, somewhat underestimated the pace of convergence within emerging markets during this decade. It is important to note that the impressive growth trajectory observed in emerging markets is a more recent phenomenon. Starting from the mid-1990s, the GDP growth of emerging markets began consistently surpassing that of developed markets (DM) that signifies a fundamental shift in the global economic landscape. This transition marked a turning point, catapulting emerging markets into the forefront of the global economic narrative.

Given the outsized role that Asian economies have played in the EM convergence story, it is tempting to claim that the narrative of EM convergence is primarily, or exclusively, a story of Asia’s convergence. In reality, convergence has become more generalised across EMs since the turn of the century.

The 2000s were marked by strong average GDP per capita growth and income convergence between emerging markets and developed economies. While GDP per capita growth declined in the US and Western Europe, it was more than offset by growth in Latin America, Africa, the Middle East and, in particular, in Eastern Europe and Central Asia. Growth in East Asian economies stayed strong. Over the decade prior to COVID (2010-19), there was a slump in average GDP per capita growth in DM and EM economies alike. Nonetheless, in contrast to the pre-2000 period, growth was distinctly faster in relatively poor EM economies than in relatively rich DM economies.

The two noteworthy aspects mentioned hold substantial implications for the future economic landscape. Firstly, over the past decade, there has been a widespread deceleration in economic growth that has affected both developed markets (DM) and emerging markets (EM) alike. This general slowdown has posed challenges to economies across the spectrum that indicates a broader trend of reduced growth rates in the global arena. Secondly, despite this overarching deceleration, the process of convergence between emerging markets and developed markets has largely endured. This phenomenon signifies that, despite the slowdown, emerging markets continue to exhibit a trajectory of catching up and converging with the more advanced developed economies. The resilience of this convergence process suggests a fundamental shift in the global economic landscape, with emerging markets steadily narrowing the gap and moving closer towards the economic standards set by developed counterparts.

Despite incorporating the lessons from past performance, the risks involved in projecting far into the future remain. The report has to be seen less as a forecast and more as a method of indicating broad global dynamics and their long-term implications. Nevertheless, there is significant value in pinning down the main drivers of growth, gathering all the information, and incorporating that information into a coherent model.

The report anticipates that China will overtake the US economy as the world’s largest economy around 2035. This is around 10 years later than their 2011 projections, primarily reflecting the downward revisions they have made to Chinese potential growth. The project also that in 2050, the world’s five largest economies will be China, the United States, India, Indonesia, and Germany. Of particular significance, India is slated to secure the third spot, underscoring its robust growth potential and ascent on the global economic stage. Moreover, Indonesia is expected to ascend, potentially displacing Brazil and Russia among the ranks of the largest emerging markets (EMs) over this horizon. These projections offer keen insights into the shifting economic tides, and India’s sustained rise to the third position marks a milestone in the evolving economic landscape.

Extending these projections to 2075 reveals a momentous shift in the global economic landscape, with China, India, and the US emerging as the three largest economies. Remarkably, India is projected to surpass the US and secure the second position, an extraordinary feat reflecting its sustained growth trajectory. However, it is noteworthy that the US is anticipated to maintain a higher potential GDP growth rate compared to China, owing to its favourable demographic outlook. Moreover, the prospect of rapid population growth in countries such as Nigeria, Pakistan, and Egypt suggests the potential for these economies to attain considerable size and prominence on the world stage, provided appropriate policies and institutions are in place. As we peer into the horizon, these projections offer a captivating glimpse of the evolving economic order and India’s ascent to the second position, signalling its potential to become a pivotal player in the global economic landscape by 2075.

Elaborating on the 2075 projections, the report further indicates that there will be a large gap between the largest three economies (China, India and the US) and all other economies. Thus, although Indonesia, Nigeria and Pakistan are projected to be fourth, fifth, and sixth in the 2075 GDP rankings, each of them are projected to be smaller than one-third of the size of China, India and the US.

As we look ahead to 2075, the projections indicate that both the Chinese and Indian economies are poised to surpass the United States in size. However, it is crucial to recognize that despite their economic expansion, the US is projected to maintain a substantial lead in terms of wealth, being more than twice as affluent as both China and India. Additionally, the wealth disparity between the US and countries like Nigeria and Pakistan is expected to be even more pronounced, with the US being five times richer than these nations.

Furthermore, the projections reveal an overall trend of slowing growth in most economies, primarily attributable to diminishing contributions from labour force growth. This deceleration is particularly noteworthy in China that implies a shift in its economic dynamics. Moreover, Brazil and South Africa, which have experienced lacklustre economic performance over the past decade or so, may witness a partial reversal of fortunes as negative productivity momentum diminishes over time.

India’s growth and resilience emerge as significant highlights amidst these projections. While it is expected to become the second-largest economy of the world by 2075, its trajectory is distinct from that of China, as its potential GDP growth remains more resilient due to a favourable demographic outlook. This resilience positions India as a crucial player in the future global economic landscape and emphasizes the importance of sound demographic and productivity policies in shaping economic fortunes. As economies adapt to changing circumstances, comprehensive analysis becomes indispensable in navigating the intricacies of long-term economic projections.

(Dr Maheep is a Leading Expert in International Relations. He has an avid interest in the political economy of India)