The crisis marks a dramatic turn of fortune for Adani, who has in recent years forged partnerships with France’s TotalEnergies and attracted investors such as Abu Dhabi’s International Holding Company…reports Asian Lite News

Adani’s market losses swelled above $100bn on Thursday, sparking worries about a potential systemic impact a day after the Indian group’s flagship firm abandoned its $2.5bn stock offering.

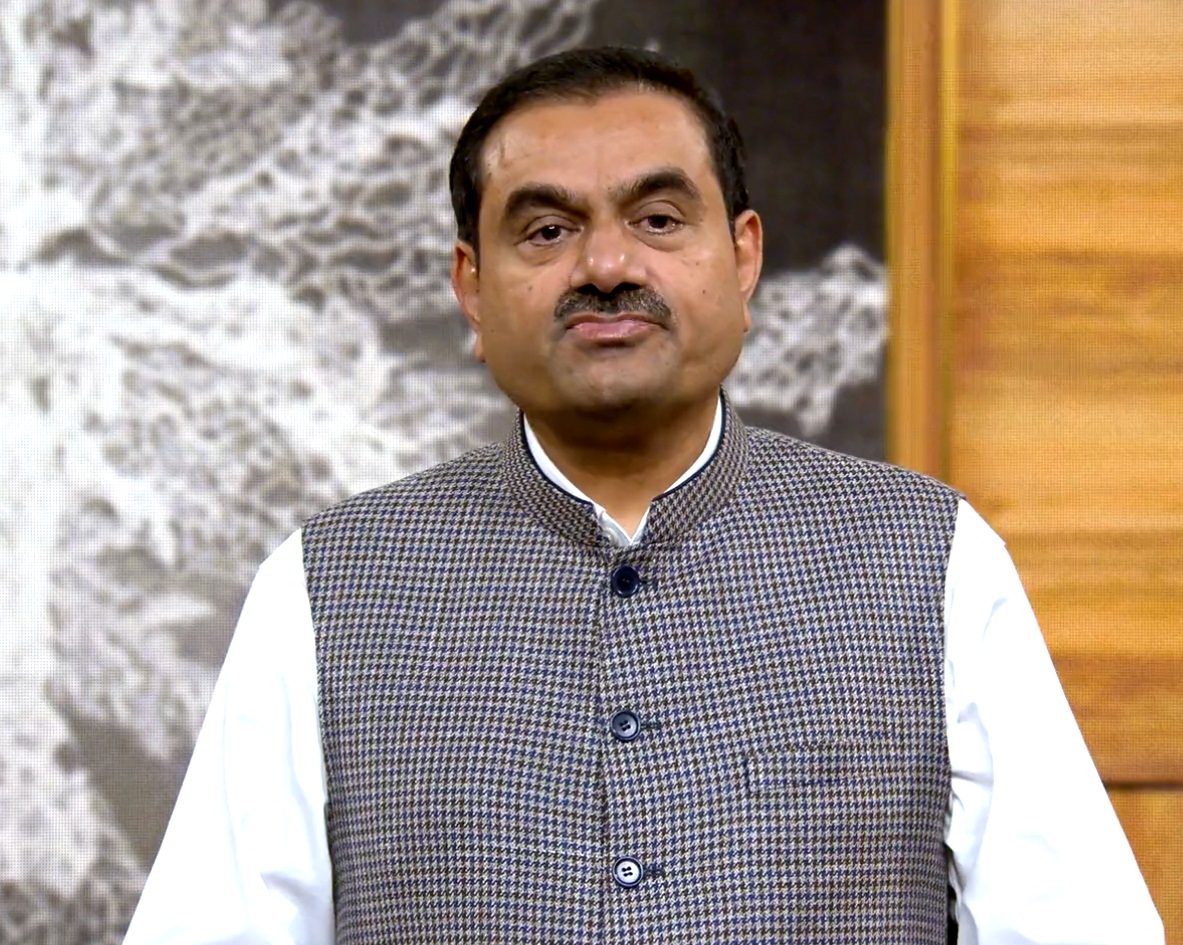

The shock withdrawal of Adani Enterprises’s share sale marks a dramatic setback for founder Gautam Adani, the school dropout-turned-billionaire whose fortunes rose rapidly in recent years but have plunged in just a week after a critical research report by United States-based short-seller Hindenburg Research.

Aborting the share sale sent shockwaves across markets, politics and business. Adani stocks plunged, opposition politicians called for a wider probe and India’s central bank sprang into action to check on the exposure of banks to the group.

Meanwhile, Citigroup’s wealth unit stopped making margin loans to clients against Adani Group securities.

The crisis marks a dramatic turn of fortune for Adani, who has in recent years forged partnerships with foreign giants such as France’s TotalEnergies and attracted investors such as Abu Dhabi’s International Holding Company, as he pursues a global expansion stretching from ports to the power sector.

In a shock move late on Wednesday, Adani called off the share sale as a stocks rout sparked by Hindenburg’s criticisms intensified, despite it being fully subscribed a day earlier.

Adani Enterprises shares tumbled by 27 percent on Thursday, closing at their lowest level since March 2022.

Other group companies also lost further ground, with 10 percent losses at Adani Total Gas, Adani Green Energy and Adani Transmission, while Adani Ports and Special Economic Zone shed nearly 7 percent.

Since Hindenburg’s report on January 24, group companies have lost nearly half their combined market value. Adani Enterprises – described as an incubator of Adani’s businesses – has lost $26bn in market capitalisation.

Adani is also no longer Asia’s richest person, having slid to 16th in the Forbes rankings of the world’s wealthiest people, with his net worth almost halved to $64.6bn in a week.

Adani’s plummeting stock and bond prices have raised concerns about a potential wider impact on India’s financial system.

India’s central bank has asked local banks for details of their exposure to the Adani Group, government and banking sources told Reuters on Thursday.

Market and investment group CLSA estimates Indian banks were exposed to about 40 percent of Adani Group’s $24.5bn debt in the fiscal year to March 2022.

Dollar bonds issued by Adani Group’s entities extended losses on Thursday, with notes of Adani Green Energy Ltd crashing to a record low. Adani Group entities made scheduled coupon payments on outstanding US dollar-denominated bonds on Thursday, Reuters reported, citing sources.

Hindenburg’s report alleged improper use of offshore tax havens and stock manipulation by the Adani Group. It also raised concerns about high debt and the valuations of seven listed Adani companies.

The Adani Group has denied the accusations, saying the allegation of stock manipulation has “no basis” and stems from ignorance of Indian law. It said it has always made the necessary regulatory disclosures.

Congress questions Group’s ties with Chang Chung-ling

Attacking the government over the Hindenburg report on the Adani Group, the Congress on Thursday questioned the relation between Chinese businessman Chang Chung-ling and the Adani group.

Citing the report, Congress leader Pawan Khera at a press conference said, “As per Hindenburg Research, Chang Chung-ling runs (or used to run) a firm called Gudami International, which was identified as part of an investigation into government fraud in the Adani Group’s alleged circular trading of gems and that Chang Chung-ling and Vinod Adani’s Singapore residential address was the same”

“The most sensational revelation that has gone unnoticed by the Indian media so far, is that of the relationship between the Adani Group and Chang Chung-ling, a Chinese businessman of questionable antecedents,” he said.

The report says, “This is a significant matter, not only for the sake of the shareholders but also for the national security of India,” he added.

He said the Modi government has maintained a stoic silence on the Hindenburg Research report, as if nothing has happened.

“We want to tell PM Modi that we have nothing to say if you cheat your best friend, but shall not keep quiet if you cheat the investors of India – 29 crore policy holders of LIC and 45 crore account holders of SBI,” he added.

Kharge calls opposition meet

Leader of Opposition in the Rajya Sabha, Mallikarjun Kharge called for a meeting of opposition parties on Friday to chalk out a strategy over research group Hindenburg’s report on the Adani Group

Both Houses of Parliament were adjourned on Thursday as the opposition demanded an investigation by the Joint Parliamentary Committee (JPC) on the new revelations.

Kharge had said on Thursday: “We demand an investigation by the JPC on the issue and will raise the demand inside Parliament. We demand that a JPC should be constituted to go into the alleged irregularities.”

The opposition also alleged that the proceedings of both Houses of Parliament were adjourned to stop them from raising the Adani issue.

ALSO READ-Adani Group gives detailed responses to Hindenburg