The ICEA noted this results in delays, inefficiencies, and higher costs — alternatives from Japan or Korea cost up to four times more than Chinese machinery.

India’s transformation into a global electronics manufacturing hub may be under pressure due to informal trade curbs by China, industry body ICEA (India Cellular and Electronics Association) has warned. In a letter to Electronics and IT Minister Ashwini Vaishnaw, the association flagged that unofficial restrictions on capital equipment, critical minerals, and skilled technical personnel by China are creating new chokepoints, threatening to derail India’s growing integration into global value chains (GVCs).

India’s electronics sector has seen exponential growth in the past decade, buoyed by policies like the Production Linked Incentive (PLI) scheme launched in 2020. Smartphone manufacturing alone reached $64 billion in FY25, with exports making up $24.1 billion — now India’s largest single export. Electronics exports have also climbed to become the third-largest after engineering goods and petroleum, hitting $38.6 billion in FY25.

“Smartphones rose from 167th in India’s export rankings in FY15 to become number one,” ICEA wrote, crediting policy foresight and private investments. However, it warned that India’s dependence on China for high-precision tools and specialised machinery — due to China’s decades of industrial consolidation — is now a strategic vulnerability.

For over a year, China has reportedly restricted exports of essential capital equipment to India across sectors. In the last eight months, these have expanded to electronics. The ICEA noted this results in delays, inefficiencies, and higher costs — alternatives from Japan or Korea cost up to four times more than Chinese machinery.

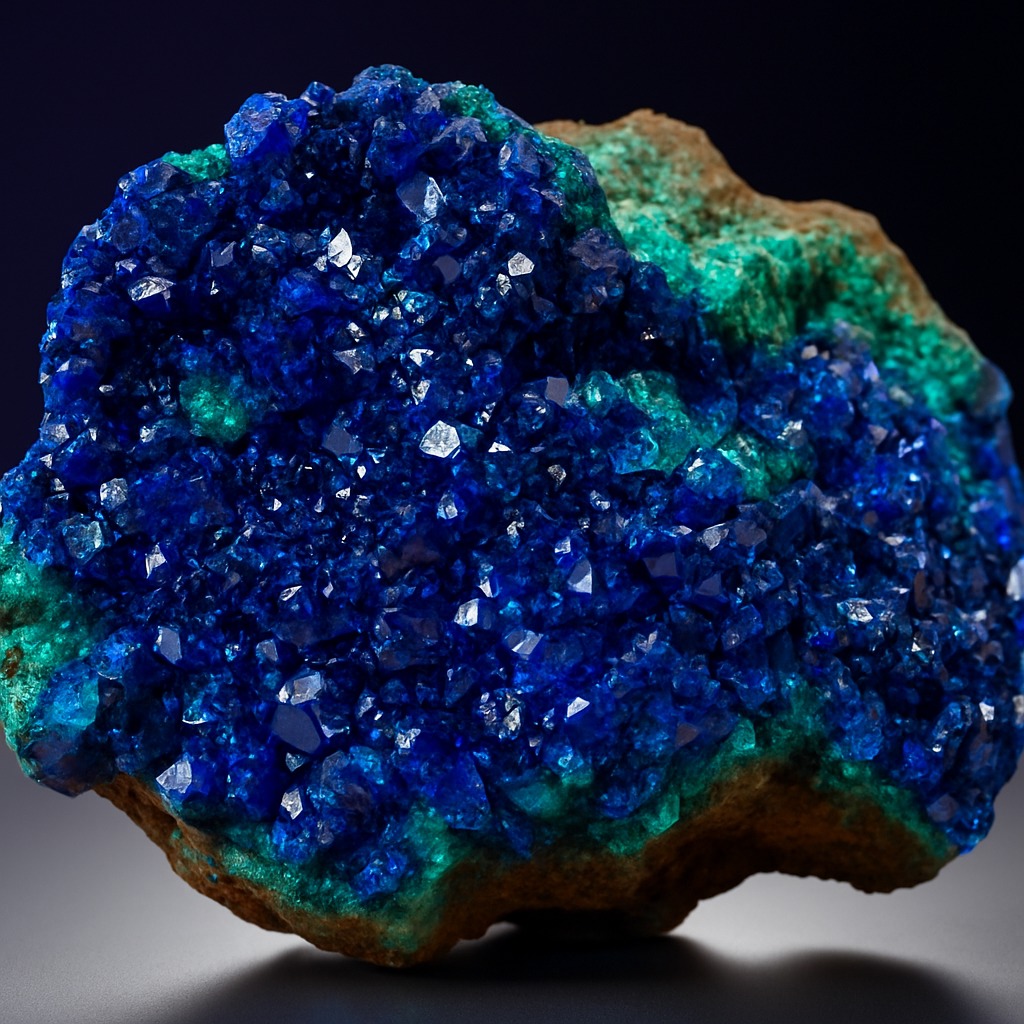

The curbs extend beyond hardware. China has also limited the export of rare earth materials crucial to smartphone manufacturing. Alternatives are either scarce, unscalable, or expensive.

Additionally, China has disrupted technical collaboration. According to ICEA, Beijing recently ordered select companies to wind up India operations and remove Indian professionals, cutting off technology transfer. More alarmingly, professionals of Chinese origin working in Indian, Taiwanese, and Chinese firms in India have been recalled to China midway through their assignments — numbering in the hundreds.

“These actions appear to be well-planned and sequential, aimed at weakening India’s ability to compete globally at scale,” ICEA claimed.

The mobile phone production industry currently employs over 17 lakh workers. Jobs tied to exports have surged more than 33 times since the launch of the PLI scheme, underscoring the importance of protecting the sector.

“India’s success mirrors the trajectory of other Asian economies — achieving scale first, then deepening domestic value addition,” said CDS Director Prof. C. Veeramani in a related study. On the China developments, ICEA Chairman Pankaj Mohindroo added, “Strategic integration into global value chains has driven India’s gains in exports, jobs, and domestic value addition. The new disruptions threaten to undo this momentum.”

The ICEA has now sought an urgent meeting with the government to address the risks posed by Chinese actions, stressing the need for long-term mitigation strategies, diversification of sourcing, and support for local capacity building. As India aspires to scale its electronics manufacturing to $500 billion, industry experts believe that government intervention will be key to navigating these evolving geopolitical and supply chain challenges.