The Atomic Minerals Directorate for Exploration and Research (AMD) and the Geological Survey of India (GSI) are actively exploring and augmenting rare earth resources, while the GSI alone has added 482.6 million tonnes of REE ore through 34 exploration projects

India holds 8.52 million tonnes of Rare Earth Element (REE) reserves, roughly 8 per cent of the global share, positioning it to play a pivotal role in global REE supply chains, especially as China’s dominance begins to wane, according to official data and a CareEdge report.

Despite having the third-largest rare earth reserves in the world, India currently contributes less than 1 per cent of global REE mining. Most reserves lie in coastal and inland sands across Tamil Nadu, Kerala, Andhra Pradesh, Odisha, Gujarat, Maharashtra, West Bengal and Jharkhand, as well as in hard rock formations in Gujarat and Rajasthan.

The Atomic Minerals Directorate for Exploration and Research (AMD) and the Geological Survey of India (GSI) are actively exploring and augmenting rare earth resources, while the GSI alone has added 482.6 million tonnes of REE ore through 34 exploration projects.

India’s low production levels prompted the launch of the National Critical Mineral Mission (NCMM) in 2025, aimed at building self-reliance in mineral security. The government has also considered production-linked incentives to strengthen domestic capabilities and reduce reliance on imports, particularly in refining and processing, where global supply chains remain heavily dependent on China.

The Ministry of Mines has signed bilateral agreements with mineral-rich countries such as Argentina, Australia, Zambia, Zimbabwe, and Peru, while participating in multilateral partnerships like the Minerals Security Partnership (MSP) and Indo-Pacific Economic Framework (IPEF) to enhance supply chain resilience.

With China currently accounting for 69 per cent of global mining and 90 per cent of REE refining, these figures are expected to decline to 51 per cent and 76 per cent respectively by 2030, as per the International Energy Agency. This shift reflects growing international efforts to diversify and decentralise REE supply.

In parallel, the Ministry of External Affairs is actively engaging partners to counteract Chinese restrictions on rare earth magnet exports. China’s informal curbs have already impacted India’s electronics sector, raising operational costs and limiting access to precision equipment and technical expertise. In response, the government-owned Indian Rare Earths Limited (IREL) is exploring a reduction in exports to prioritise domestic processing.

To secure global supply, India set up Khanij Bidesh India Limited (KABIL)—a joint venture that has signed an agreement with Argentina’s CAMYEN for lithium exploration across five blocks and is in active talks with Australia’s Critical Minerals Office for similar acquisitions. Government-to-government MoUs with Brazil and the Dominican Republic are also in the pipeline.

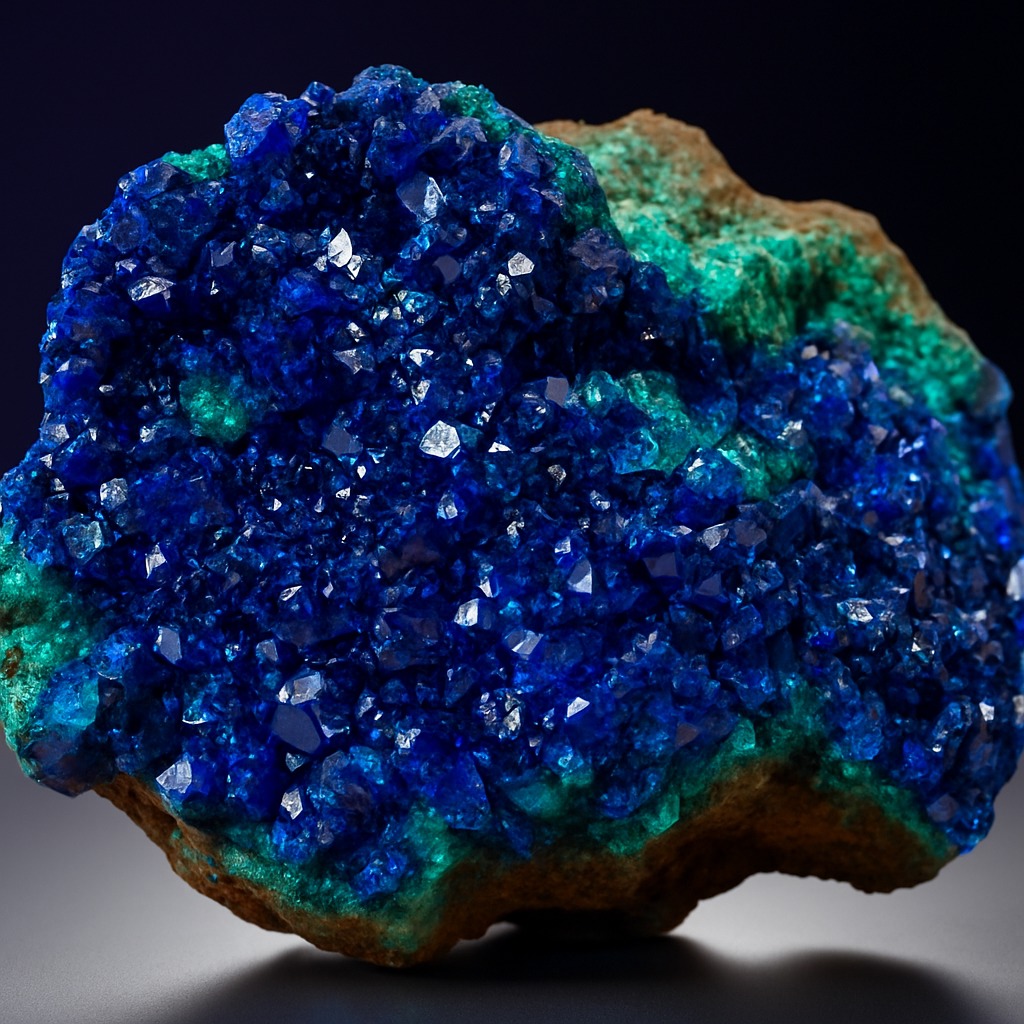

Critical minerals such as neodymium, praseodymium, dysprosium and terbium are vital for high-tech industries ranging from electric vehicles and wind turbines to defence and aerospace systems. These rare earths are classified into Light REEs (LREEs) and Heavy REEs (HREEs), each serving different strategic functions, from EV motors to military-grade magnets.

Globally, countries like the US have invested over $439 million since 2020 to build domestic REE capabilities, but refining remains a bottleneck, with most US-extracted ore still sent to China. As the global REE landscape evolves, India is expected to play an increasingly influential role, provided it can scale production, simplify regulatory processes, and expand refining capacity.

Dr Jitendra Singh, Minister of State, said efforts are underway to integrate India into emerging international critical mineral partnerships, ensuring long-term strategic and technological autonomy.