The United Arab Emirates (UAE) Etihad Aviation Group on Friday said that it has signed a memorandum of understanding (MoU) for cooperation with China’s Jiangsu Provincial Overseas Cooperation and Investment Company (JOCIC)…reports Asian Lite News

The MoU, signed by Etihad Aviation Group CEO Tony Douglas and JOCIC Chairman Luo Hua, pushes for cooperation on a “wide range of areas” to better support the development of the China-UAE Industrial Park in Abu Dhabi’s Khalifa Port, Etihad said in a statement.

The cooperation covers air logistics, procurement, mutual promotion on respective premises and digital channels, the statement added.

The MoU will also provide companies investing in the China-UAE Industrial Park with preferred air transportation and cargo rates on the routes to and from China covered by Etihad Airways, which is controlled by the government of Abu Dhabi.

JOCIC and companies of the China-UAE Industrial Park designated Etihad Airways as their preferred airline.

The memorandum will also promote Abu Dhabi’s “unique geographic advantages” and Etihad Airways’ convenient network, which support China’s Belt and Road Initiative.

Douglas said China is a strategically important market for Etihad and the partnership will “strengthen the position of Abu Dhabi as an aviation hub to connect China with the economies along the Belt and Road Initiative by leveraging our strong global network”.

In April 2008, Etihad Airways launched its first direct passenger flights from Abu Dhabi to Beijing.

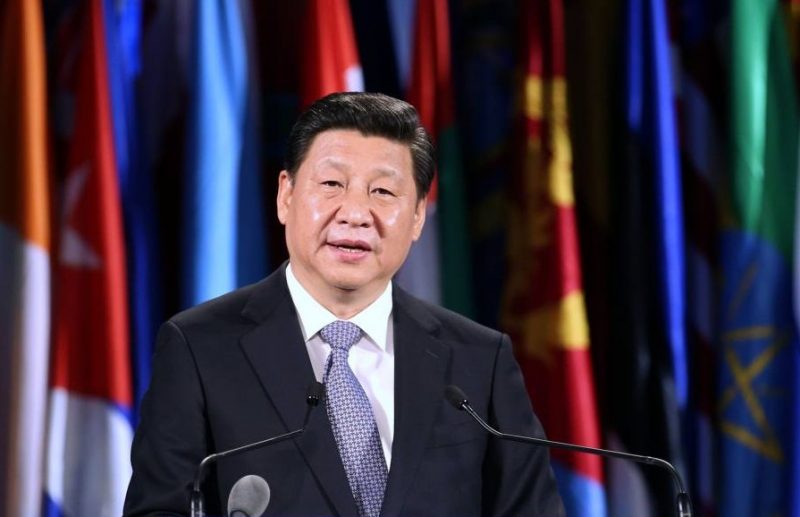

“The China-UAE Industrial Park is a major project under the Belt and Road Initiative,” Luo said. “It represents an important consensus reached by the leaderships of China and the UAE to strengthen international industrial capacity cooperation.”

Established in July 2017, with a 50-year agreement signed between Abu Dhabi Ports and JOCIC, the China-UAE Industrial Park has successfully achieved investment agreements with 16 Chinese companies, totalling $1 billion in value.

The Chinese companies investing in the industrial park are from sectors including new energy sources, aluminium processing, machinery manufacturing, trade and logistics, chemicals, packaging and more.