Coming to the markets in the week ahead. We are passing through tough times and FII’s seem to sell non-stop irrespective of markets. With key supports broken, one can only expect markets to bounce to regain some of the lost ground…reports Arun Kejriwal

It was a topsy-turvy week and the good part was that it was for just four days. Markets were super volatile and lost on two of the four trading days with the remaining two being flat. BSESENSEX lost 2,225.31 points or 3.90 per cent to close at 54,835.58 points, while NIFTY lost 691.30 points or 4.04 per cent to close at 16,411.25 points. The broader markets saw BSE100, BSE200 and BSE500 lose 4.11 per cent, 4.17 per cent and 4.04 per cent, respectively, while BSEMIDCAP lost 5.28 per cent and BSESMALLCAP lost 5.31 per cent. Stocks across the board were under pressure and there were just a handful of gainers in all.

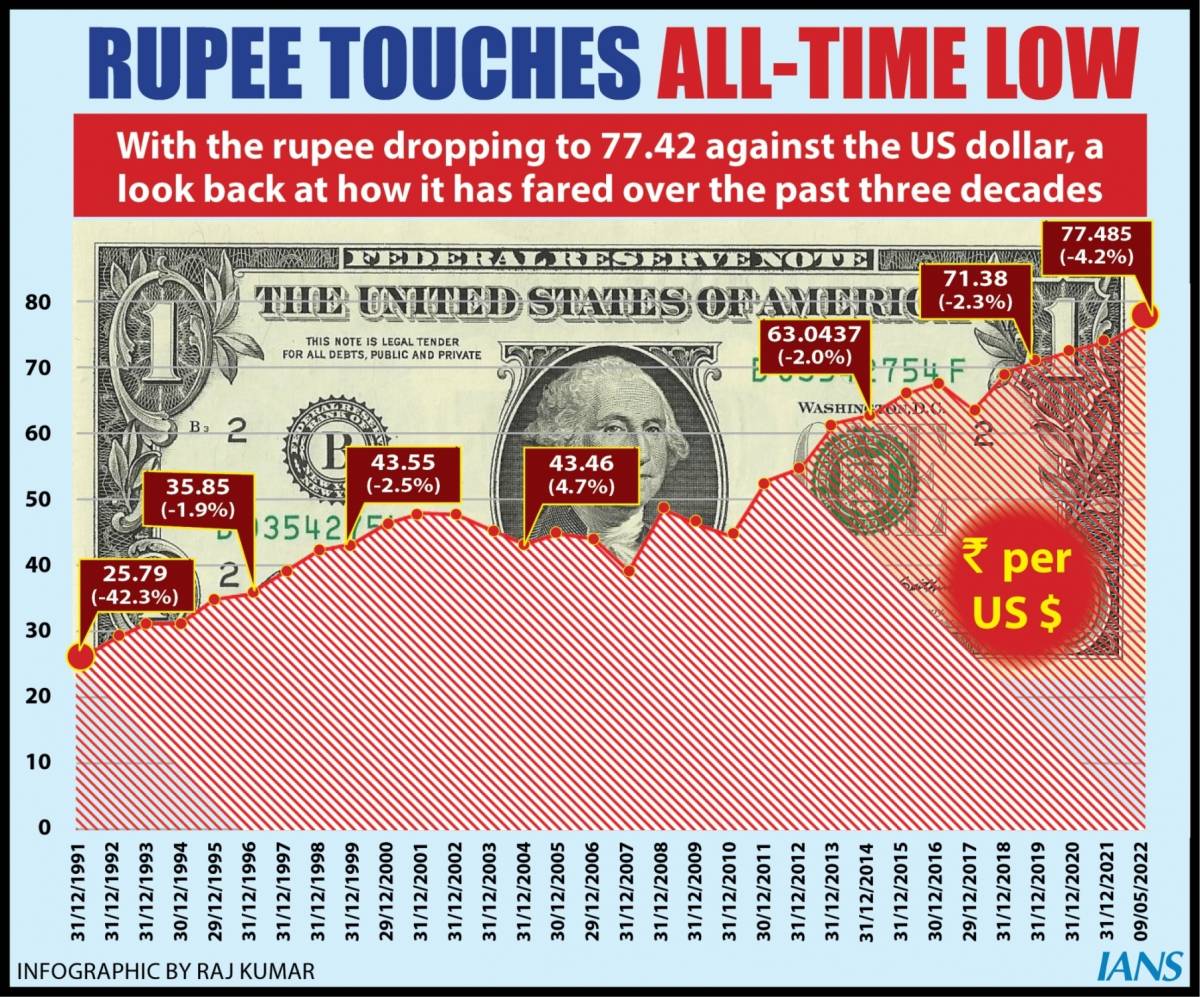

The Indian Rupee was under pressure and lost 50 paisa or 0.65 per cent to close at Rs 76.92 to the US Dollar. Dow Jones had a choppy week and managed to close virtually flat. It lost 77.84 points or 0.24 per cent to close at 32,899.37 points.

The US Fed raised interest rates by the widely expected 50 basis points on Wednesday but saw Dow Jones rise 932 points on the day of the announcement. On Thursday, after having caught all short sellers on the wrong side the previous day, markets tanked 1,063 points. Friday saw markets opening weak and lose intraday about 525 points before recovering to close with losses of just 98 points. Markets have become vulnerable in the US and there is a wider belief that there would be another 4 rate hikes of 50 basis points or more in the next 10 months.

In India, RBI Governor Shaktikanta Das called a surprise conference on Wednesday and announced a sudden and unexpected rate hike with effect from May 21. Repo rate has been hiked by 10 per cent from 4 per cent to 4.40 per cent while CRR has been hiked by 50 basis points to 4.50 per cent from the earlier 4.00 per cent. This hit our markets quite badly on Wednesday and we lost about 1,300 points on Wednesday. Looking at Dow doing well later that evening, our markets gained intraday on Thursday about 900 points but closed with gains of a mere 33 points. Friday was a big red day with losses of 870 points. Markets have broken key support zones in the previous week and we can expect some recoveries at best in the coming days. For the trend to change to positive it would be a long haul and we would need big news flow for that to happen.

The issue from LIC has opened and has been oversubscribed 1.63 times as of Saturday. There are 53.87 lac forms in the retail category which have been received. This is a new record for itself in terms of retail subscription. The issue is open for bidding on Sunday and the last day is Monday. There is a group of people who believe that shares of LIC would be available at a substantial discount to the issue price in less than six months. While each person is entitled to their own opinion, would like to just make two points here. The first is that there would be no dilution beyond the 3.5 per cent through this issue for a period of a minimum 12 months. Second the present EV or Embedded value is based on 5 per cent of profits being kept aside for shareholders. This would increase to 7.5 per cent and then to 10 per cent in the next two years. When profit component increases, the EV value increases. Take your call and use the last day to subscribe or choose to stay away.

The week ahead would see shares of Campus Activewear Limited list on May 9 and shares of Rainbow Children’s Medicare Limited list on May 10. These two issues would be the first under the new rules of subscription of HNI bucket and RBI rule of 1 crore limit for HNI’s.

The week ahead has two primary issues as well with the issue from Prudent Corporate Advisory Services Limited tapping the markets with its offer for sale of 85.49 lakh shares in a price band of Rs 595-630. The issue which has a size of Rs 538 crore would open on May 10 and close on May 12. The company is primarily a distributor of products manufactured by mutual funds and caters to authorised advisors and also to individual investors directly. The company has increased its AUM from Rs 32,000 as of March 31, 2021, to Rs 48,000 crore at the end of December 21. There is a one-off item of acquisition of Rs 8,000 crore from Karvy at the end of November 21 at a cost of Rs 150 crore. This acquisition generates a revenue or yield of 65 basis points for Prudent. The company has earned and EPS of Rs 13.94 for the nine months ended December 21. Annualising the same for the 12 months and considering an additional income for the Rs 8,000 crs acquisition, the EPS for the full year 21-22 would be around Rs 19.50. At this EPS the PE band is 30.5-32.30. Considering the fact that the recently listed issue from Anand Rathi Wealth Limited reported an EPS of Rs 30.18 for FY22 and is trading at a PE multiple of 20.84 which is substantially cheaper, investors may form a valued opinion and make their own choice.

The second issue is from Delhivery Limited which is tapping the markets with its fresh issue for Rs 4,000 crore and an offer for sale of Rs 1,235 crore in a price band of Rs 462-487. The issue would open on May 11 and close on May 13. Delhivery is the largest integrated logistics player and reported revenues of Rs 4,810 crore for the nine months ended December 2021. It has made seven acquisitions in this nine-month period and the full revenue impact based on current revenues would see a revenue increase of roughly Rs 300 crore per quarter going forward. The company has been incurring losses since inception and even for the nine-month period it lost roughly Rs 890 crore which included a non-cash item of Rs 299 crore.

While the logistics business in India is highly fragmented and the opportunity for the segments in which Delhivery is present is over 300 billion dollars, its present revenue is still to cross 1 billion. The opportunity is there, the company has spent in acquisitions and setting up the infrastructure. It has also learnt the ropes over the last few years. Turning the opportunity into sustainable profits maybe some time away. How long? A question which has no answer currently. In the shorter term look at Blue Dart Express Limited which has revenues of Rs 4,400 crore in 12 months ended March 2022 and a profit after tax of Rs 376 crs. The EPS is Rs 158.65 and the market cap Rs 16,219 which is less than half of Delhivery at Rs 35,000. Makes sense to invest in two shares of Blue Dart which would translate into Rs 13,670 against a lot of Rs 14,610 for Delhivery. Allow the share to list and wait for the turnaround in Delhivery and time your switch.

Coming to the markets in the week ahead. We are passing through tough times and FII’s seem to sell non-stop irrespective of markets. With key supports broken, one can only expect markets to bounce to regain some of the lost ground. Expect immediate resistance at levels of 56,000 and then at 57,000 on BSESENSEX and at 16,850 and then at 17,100 on NIFTY. This does not suggest that these are immediate targets but what could be levels in the medium term. The strategy would be to sell on strong rallies and buy on dips with traders avoiding overnight positions. The US markets are currently worrisome and do not provide clues as to how they would fare.

Trade cautiously and use large swings on the downside to buy and upswings to sell. Being patient would always help and with the pent-up demand of primary issues likely to tap markets, pick and choose to tap the markets.

ALSO READ-Bitcoin value dropped below $34,000