Jaywan aims to provide secure, efficient, and cost-effective payment solutions for individuals and businesses…reports Asian Lite News

Al Etihad Payments (AEP), a subsidiary of the Central Bank of the UAE (CBUAE), has announced the readiness of Jaywan, the country’s first domestic card scheme, designed to enhance financial infrastructure and boost the UAE’s position as a global leader in digital payments.

Aligned with the UAE’s digital transformation strategy, Jaywan aims to provide secure, efficient, and cost-effective payment solutions for individuals and businesses. The initiative will not only reduce transaction costs but also accelerate local payment processes via the UAESWITCH, fostering economic growth, innovation, and financial inclusion.

The scheme will offer a range of debit, credit, and prepaid cards, available in basic and premium variants. Jaywan cards will be accepted across various payment channels, including online transactions, ATMs, and point-of-sale (POS) terminals.

Licensed financial institutions will issue two types of Jaywan cards: 1. Mono-badge cards (Jaywan only) for local use and in GCC countries; 2. Co-badge cards in partnership with global payment networks to ensure international usability.

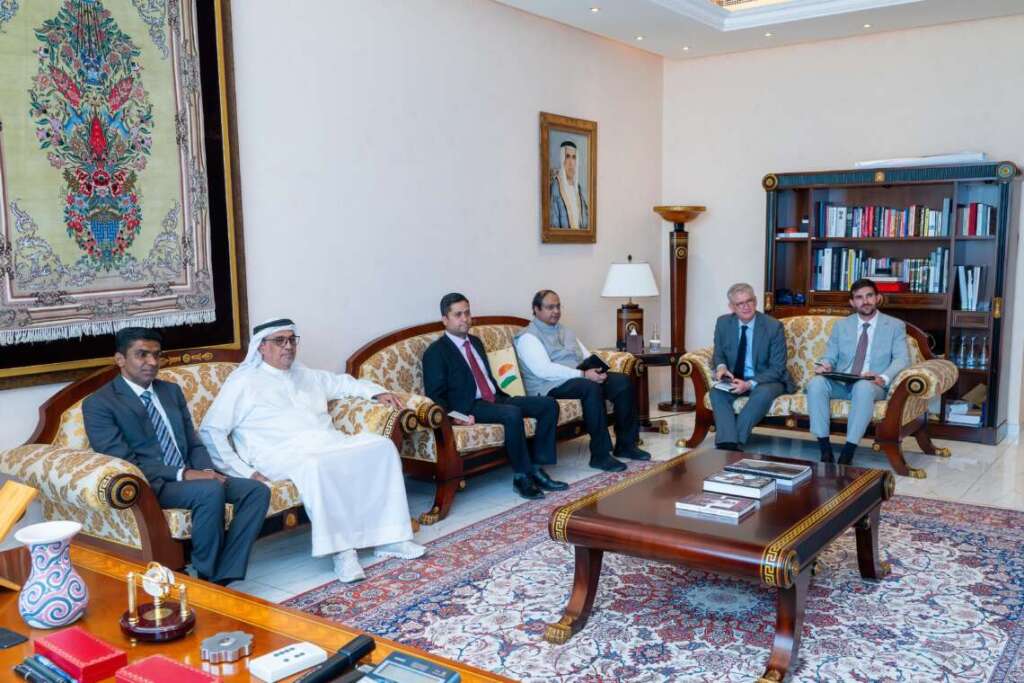

AEP has already signed agreements with major international payment providers—Discover, Mastercard, Visa, and UnionPay—to facilitate the seamless use of Jaywan cards worldwide. Additionally, a Memorandum of Understanding (MoU) has been signed with Samsung Gulf Electronics to integrate Jaywan cards into Samsung Wallet, allowing smartphone payments. Future integration with Google Pay and Apple Pay is also planned.

By mid-2025, Jaywan will expand further with bilateral agreements with India and other international markets.

To raise awareness, AEP will launch a public campaign in April 2025 to educate consumers and businesses on Jaywan’s features, benefits, and role in reducing payment costs while ensuring secure, seamless transactions.

Saif Humaid Al Dhaheri, Assistant Governor for Banking Operations and Support Services at CBUAE and Chairman of Al Etihad Payments, described Jaywan as a key milestone in the UAE’s digital payment evolution. “This initiative enhances electronic payment competitiveness, supports financial inclusion, and accelerates our digital transformation strategy,” he said.

Jan Pilbauer, CEO of Al Etihad Payments, highlighted Jaywan as a game-changer for the UAE’s payment ecosystem. “We have worked closely with industry stakeholders to develop a national card scheme that empowers users with greater control, convenience, and security. This is another step towards building a flexible and future-ready financial infrastructure,” he added.

With its growing global reach and seamless integration into modern digital payment platforms, Jaywan is set to redefine the UAE’s financial landscape, offering a locally-driven yet globally accepted payment solution.